You have decided specifically where you’d like to move – perhaps you’ve even found the exact home or apartment in which you’d like to live. What’s next?

In this second part of Your Guide to Moving and Buying a Home, you’ll be able to answer the following questions:

- What are the best ways to get all my stuff into my new home?

- I’ve written tons of important knowledge down in this section – skip ahead to the “Moving Your Stuff” section of this guide to learn more.

- How do I get a mortgage?

- What is the home offer process like?

- What is the closing process like?

Please note that I am writing this guide based on my years of personal experience and hundreds of hours of my own research. Your experience may differ!

Table of Contents

I need a mortgage! How do I get one? Also, what is a mortgage?

If you can’t afford to pay cash for the home or condo of your dreams, you’ll need to get a loan from a bank, mortgage company, or credit union to help supplement your cash. To obtain that loan, you’ll need to first pay the bank a percentage of the value of the home. That cash payment is called a down payment, and they’re usually 5-30% of the value of the home. However, in today’s housing market, many folks are often unable to afford more than a 5-10% down payment.

Getting a mortgage is extremely common and reasonable, and plenty of sellers are still perfectly willing to accept non-cash offers backed by mortgages.

Background Info

A quick note: Even though the terms are often used interchangeably, a “mortgage” and a “home loan” are two different things:

- “A mortgage is an agreement between you and a lender that allows you to borrow money to purchase or refinance a home and gives the lender the right to take your property if you fail to repay the money you’ve borrowed.” (consumerfinance.gov)

- A home loan is the money that a lender gives to you which lets you send the full amount of money associated with your home offer to the seller. Once you pay off a home loan, your mortgage disappears.

Before you’re ready to get a mortgage quote, you can use a tool like this one on Nerdwallet.com to determine the current ballpark of mortgage rates. Nerdwallet also offers a useful mortgage calculator which lets you determine a monthly payment based on a given home purchase price, down payment, and other factors.

Also, before you reach out to any banks or credit unions for a rate quote, recognize that rates change daily. Sometimes, mortgage rates can even change multiple times within one day. When you are ready to get a quote, you should be ready to act on that quote.

Finally, note that there are several different types of mortgages, each with different terms and rates. For example, a 15-year fixed-rate mortgage will often have a lower rate (and cost less over the lifespan of the loan) than a 30-year fixed-rate mortgage. A jumbo loan will often have a higher down payment requirement and a higher rate than a conventional loan.

Mortgage Shopping

Shopping around for mortgages can be very overwhelming – there are so many providers, you have to provide a concerning amount of personal information to obtain a quote, and sometimes banks quote considerably higher rates than what they advertise.

Here’s the best way I found to shop for rates:

- Start with a list of providers from a recent mortgage review article, like this one from NerdWallet.

- In new tabs, navigate to the homepages of at least five of those mortgage providers.

- Don’t click on a “Learn More” link on a review website or mortgage aggregator website – by clicking on those links, you’re passing some data to that provider’s site, and you’re not getting an unfettered, clean, new-user experience like you would if you manually visited the site yourself.

- In each of those 5+ tabs, poke around the provider’s website. Note how you feel using their site. Try to get a sense for how much you trust that provider and want to work with that provider based on your experience reading and navigating their site. If you feel uncomfortable using a site, just close the tab and don’t look back – there will be better options.

- It bothers me when a bank’s website makes me feel like the bank is trying to extract the most amount of money from me, or makes me feel like that bank is in any way predatory. It’s important that you feel comfortable working with your mortgage lender.

- After the above step, you should be left with at least 3 tabs open to 3+ different mortgage providers. Try to find general information about the rates the provider offers. Close the tabs associated with providers offering noncompetitive rates.

- Whittle down the number of browser tabs you have open to the 3 most appealing providers. Finally, get accurate quotes from those three providers.

Be aware – once you sign up to get mortgage quotes, you will likely be put on several email and snail mail marketing lists, even if you’re wary to check the various “don’t email me” checkboxes. Prepare for unwanted spam!

Getting a Mortgage Preapproval

When you sign up to get a mortgage quote, you’re often able to get preapproved at the same time by providing some additional information. If you are seriously shopping for a home, or if you already have a home that you’d like to buy in mind, it’s critical that you obtain that mortgage preapproval, which is a letter from the lender indicating the type of loan and amount of the loan. Without that preapproval letter, a seller isn’t going to take your offer seriously.

I’m ready to make an offer! What’s that process like?

Now that you’ve found your dream home and obtained a quote and preapproval letter from a bank, mortgage company, or credit union, it’s time to make an offer on the house!

Making an offer on a house consists of:

- Obtaining a bunch of paperwork

- Thoroughly reading a bunch of paperwork

- Making a bunch of choices about what to include in your offer – for example:

- Do you want to waive your right to inspect the home before purchasing and purchase the home “as-is?” Purchasing “as-is” yields a more compelling offer to a seller, but introduces risk that the home is problematic in ways you’d rather not fix.

- For example, if you buy “as-is,” and there’s a water leak in the basement, the sellers aren’t responsible for fixing that leak before you move in. However, in most areas, the sellers would still be required to disclose that there’s a water leak in the basement.

- Do you want to offer a dollar amount below the asking price, at the asking price, or above the asking price?

- Do you want to include an “escalation clause” in your offer, which will increase the amount you’re willing to pay for the house up to a certain amount, given external competing offers?

- Do you want to ask for certain things to “convey,” or be included with the house, such as wall-mounted mirrors, electronics, shelves, and other furniture? Typically, large appliances are included with the house, but even that information must be specifically included in the offer. The more you ask to be included, the less compelling the offer may be to a seller.

- When do you want to set your closing date? Sellers often prioritize a shorter time to closing.

- Do you want to waive your right to inspect the home before purchasing and purchase the home “as-is?” Purchasing “as-is” yields a more compelling offer to a seller, but introduces risk that the home is problematic in ways you’d rather not fix.

- Filling out and signing a bunch of paperwork, integrating those choices

- Sending that bunch of paperwork to the sellers

If you’re working with an agent, they’re going to be a huge help to you during this part of the process. They’ll give you the paperwork to fill out, give you advice about what to include with your offer, and take care of sending the paperwork to the sellers.

Making an offer on a house isn’t actually a huge deal. It’s straightforward and only takes a couple of hours.

Once you send your offer to the sellers, you wait for their response.

The sellers approved my offer! Now what?

Wahoo! Congratulations! You’re partially through this fast whirlwind of activity that will hopefully end with you standing inside a house that you own.

Under Contract

Once the sellers accept your offer, the house is officially “Under Contract.” It’s not quite yours yet, though – a number of things have to happen before the sellers will hand you the keys, including:

- Your mortgage lender has to approve the purchase of the home and give you the all-clear to close.

- The value of the home must be appraised by a licensed professional

- If the home does not appraise at or above your purchase price, your lender may not agree to loan you the full amount of money you want.

- If your offer included an inspection clause, you must complete the inspection and the sellers must fix any problems the inspector finds.

- If the house is in an HOA, you must approve of the HOA rules and documents.

- If you don’t approve of the HOA rules as outlined by their official documents, you can usually back out of a contract.

These things are called contingencies, and those contingencies must clear before closing. If they don’t, the house will be released back onto the market and you’ll have to start the process over again.

Sale Pending

Once all of your contingencies have cleared, the status of the house will change to “Sale Pending.” At this point, you just have to wait for your closing appointment – the house is very close to yours.

Head to your closing appointment, fill out some final paperwork, take possession of the keys, and head to your new home. There’s no feeling quite like this one. Enjoy it!

Something Will Go Wrong, and That’s Fine

Please understand – somewhere in this process, something will go unexpectedly wrong, and you will deal with it.

For my wife and me, our lenders pushed out the closing date by two days when we were already in the state, ready to move. Then, on the rescheduled closing date, our lenders didn’t send the paperwork to the title company in time for our closing appointment, and I couldn’t get a hold of our lending agent on the phone because she was on vacation. I was frantically calling and emailing the bank, who eventually sent over the proper documentation. That was stressful.

Something like that will probably happen to you, and you’ll be OK.

Moving Your Stuff

You’ve closed on your house, and now you need to move all of your stuff. Hopefully you’re read this part of the guide before actually closing on the house, because moving your stuff requires planning several weeks in advance and lots of work. However, this work is very manageable if you break it up into smaller steps. Let’s get started!

Make a Detailed Home Inventory Spreadsheet

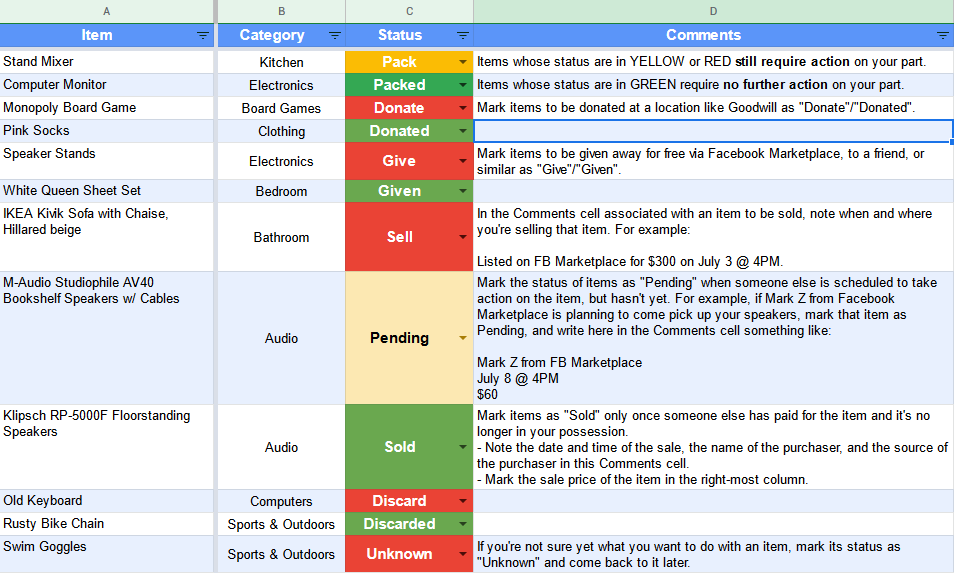

It’s important for you to know what you own before you move it. By making a home inventory spreadsheet, you’ll have an easier time figuring out what to keep and what to get rid of, you’ll be able to give your movers an accurate inventory estimate (this is critical if you’re using movers), and you’ll know that everything arrived after the move. Plus, it’s just nice to know what you own.

First, open this Google Sheets template, and make a copy of it to your own Google Drive.

Instructions for using the Sheet are already in the Sheet. It is organized and preformatted according to dozens of hours of optimizations I made while going through my own belongings. If you have any suggestions for improving this sheet, please leave a comment below.

It’s best to get super detailed when filling out this sheet. Document everything.

Sell, Donate, Give, or Discard Unwanted Belongings

As you complete your Home Inventory spreadsheet and mark items as “Sell,” “Donate,” “Give,” or “Discard,” you’ll have to take action on those items.

Selling Unwanted Belongings

There are only two viable ways to sell your unwanted belongings:

- Facebook Marketplace

- Start here. If your item is priced correctly, it’s not too niche, and you post your item during the day, you’ll have at least one offer within minutes – sometimes even seconds.

- It is free to list items on FB Marketplace.

- Do not list your items as available for shipping on FB Marketplace. Items available for shipping on FB are generally shady; local pickup only is the way to go.

- eBay

- Post items on eBay if they don’t sell on Facebook.

- It costs money to list and sell items on eBay.

- You are able to list items on eBay as “available only for local pickup,” although that limits your audience considerably.

Other sales marketplaces, like Craigslist or OfferUp, require way more work to make a sale. It just isn’t worth the effort to sell elsewhere.

To properly price your belongings:

- Head to eBay and search for your item.

- On the left, expand “Show only,” then click “Sold Items.”

- Look through the last several results that are in comparable condition to your item.

- Average the sale price of those items, removing outliers if possible.

If you’re selling your item on Facebook Marketplace, consider decreasing your sale price by ~10% versus the average sold eBay price to make your listing more appealing, since selling locally is usually considerably more convenient.

If you want your item to sell quickly, consider decreasing your sale price by as much as 75% versus the average sold eBay price to just get stuff out of the house. You’ll make someone else very happy by giving them a deal.

Pack your listing title and description densely with as much information as possible in as few words as possible. In your item description, add relevant details such as:

- Why you’re selling the item

- How long you’ve owned the item

- Whether you’re the original owner of the item

- The cosmetic condition of the item

- The working condition of the item

Most importantly, provide excellent photos of your item, shot in good lighting conditions. Or, hire Zach Fox Photography to professionally photograph your belongings. 😊

When you get Facebook messages asking “Is this item still available?”:

- Navigate to the user’s Facebook profile, and use your best judgement to ensure that the person is not a scammer or bot.

- Respond with “Yes, are you available to pick it up at <insert location here (it’s OK to use your home address)> at <insert time close to “now” here>?” Do this with every inbound message.

- Eventually, someone will say “Yes, I’m available there and then.” Confirm that you’ve received that message. Immediately prioritize the person who is able to pick up your item soonest.

- Mark the item in your Inventory spreadsheet as “Pending,” along with the name of the person buying the item and when they are coming to pick it up.

- Mark the item on Facebook Marketplace as “Pending” (it is hard to navigate the UI and figure out how to do this).

- If someone messages you after you’ve confirmed a pickup time and location, respond with: “Someone else is scheduled to pick this up. If that deal falls through, I’ll send you a message.” Alternatively, ignore them.

- Once the person comes to pick up your item and pays you, mark the item on your Inventory spreadsheet and on Facebook Marketplace as “Sold”.

If the original deal falls through, message all of the folks who you messaged in (6), and restart from (2).

Donating Unwanted Belongings

Look for a local Goodwill or Salvation Army drop-off point, and drop off your items there.

Don’t donate items in poor condition; nobody will want those things and you’re just creating extra work for the donation center employees.

Giving Away Unwanted Belongings

First, ask friends if they want your stuff. It’s nice to give stuff away to friends, even if you know you could sell that stuff for money.

Post items that you want to give away for free on Facebook Marketplace. When posting these items, follow the same rules and instructions as listed under “Selling Unwanted Belongings.” You’ll usually get messages within minutes.

Discarding Unwanted Belongings

If you can’t sell, donate, or give away your unwanted belongings, you can either throw your unwanted belongings in the trash (boo) or recycle them (slightly less boo).

Try to recycle as many electronic items as you can. E-waste can be mined for precious metals, which can then be re-used in other electronic devices.

If you see an icon like this one on an item, then you can’t throw it away in your regular trash bin:

Instead, you’ll need to dispose of these items at a dedicated hazardous waste disposal facility. Do a Google search for “universal waste disposal near me” and take those items to a location you find in those search results. Yes, this is annoying. Yes, there should be a better way.

Select the Method for Moving

In my experience, there are three good ways of moving your belongings, each with unique pros and cons:

- Rent a U-HAUL and move everything yourself (Least expensive; Most labor intensive; Total control)

- When I moved the contents of a 1BR apartment 14 miles from Oakland to San Francisco in November 2017, I paid $104 for a One Way Move with a 15′ Truck, plus fuel costs, plus the cost of paying for lunch for my friends who helped me move. It was great, and cheap.

- Use a self-packing service like PODS or 1-800-PACK-RAT (Somewhat expensive; Still labor intensive; Lots of control)

- When we moved the contents of a 2BR apartment cross-country 2,800 miles from Sunnyvale, CA to Frederick, MD in November 2020, we paid $4,457.88 for a 16′ 1-800-PACK-RAT container, plus the cost of paying for dinner for our friends who helped us move. It was great.

- Hire full-service movers (Most expensive; Minimal labor; Minimal control)

- When we moved the contents of a minimally-furnished 5BR house 243 miles from Frederick, MD to NYC in May 2022, we paid $4,621.25 to International Van Lines. It was great.

- Book a full-service mover weeks in advance, or else you risk zero availability.

Buy Boxes and Moving Supplies

No matter which of the moving options you choose, I recommend that you also choose between one or a combination of the following options for packing containers:

- Find boxes that others are giving away (Least expensive; Most labor intensive; Minimal control)

- Buy fresh cardboard boxes from Home Depot or similar (Costs vary dramatically; Labor intensive; Maximum control)

- Rent moving containers from a service like ZippGo or Rentacrate (Cost-effective; Minimal labor; Lots of control; Not available in all areas)

- It cost me $129 in November 2017 to rent 25 boxes from ZippGo, which is enough boxes to move the contents of a 1BR apartment.

Should you decide to take or buy cardboard moving boxes and other moving supplies, I’ve found that online calculators for estimating necessary packing supplies simply don’t work very well. Instead, if possible, I recommend that you make multiple trips to the supplies store and pick up what you need, when you’ll need it.

At the very least, you’ll probably need:

- A mix of small, medium, and large cardboard boxes

- Packing paper for filling empty space and wrapping belongings in those cardboard boxes

- Bubble wrap for the most fragile of items, like glasses and certain decorations

- A TV box for moving a TV, like this one (which works great)

- Packing tape (more of it than you think)

- A permanent marker for marking the contents of boxes

- It’s easy to think “Oh, I’ll remember what’s in this box.” You won’t remember what’s in that box. Write the contents of the box on its top and at least one side (on the side so you can read the contents when the boxes are stacked).

Dish and glassware boxes are convenient, but not necessarily worth the extra cost; you can totally get away with moving dishes and glassware in regular boxes as long as the dishes are nicely wrapped.

Pack and Move

You have the boxes, you have the moving method – now it’s time to get everything into boxes and move it all!

The packing process can take anywhere between a couple of days to a month, depending on what you’re moving. Get started early, and pack at least one box every day. You’ll be finished packing and moving before you know it.

If you’ve chosen to hire movers, trust them to do the work. Listen to music or read or watch some YouTube videos while they pack. It’ll just make you anxious to watch them, especially if, like they did mine, they are packing up your super thin OLED television (it survived, no problem).

I am so excited for you.

End of Guide Part 2

I hope you learned something while reading this guide! Please leave me a comment below if you have any questions. I’d also love to hear from you if you used any of this guide to help you move.

Since publishing Part 1 of this guide at the end of January 2022, my wife and I have sold our Maryland home and moved into an apartment in New York City. Perhaps a Part 3 of this guide will explore the selling process!